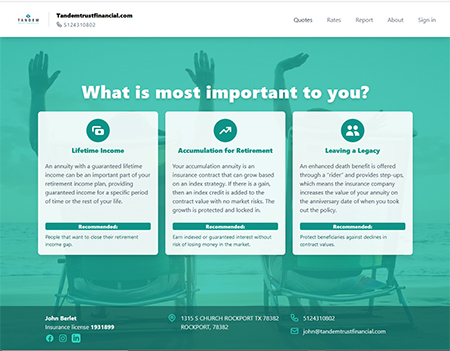

Learn more about the various annuity options available that can help you secure your retirement income.

Download

John Berlet

(512) 650-2653 John.Berlet@RetirevoMail.com

Licensed in 33 states. John Berlet CA Ins Lic #0f06781, John Berlet TX Ins Lic #2609695

Learn about some of the strategies you can consider to maximize your Social Security benefit.

DownloadFill out the form below with your questions and for updates to our full library of retirement planning articles, videos, and downloadable booklets.

1315 S Church Street Rockport, TX 78382

(512) 650-2653

Disclaimer: The information presented here is intended as information only and is not intended to represent tax, legal, or investment advice. Financial products can differ based on state of residence, age and product selected. Many financial products such as annuities may contain surrender charges and/or restrictions on access to your funds. Optional lifetime income benefit riders are used to calculate lifetime payments only and are not available for cash surrender or in a death denefit unless specified in the annuity contract. In some annuity products, fees can apply when using an income rider. Guarantees are based on the financial strength and claims paying ability of the insurance company. Read all insurance contract disclosures carefully before making a purchase decision. Rates and returns mentioned on any program presented are subject to change without notice.